Simple, Accurate & Compliant Payroll Software

- Accurate & Timely Payroll, Everytime!

- 100% Compliant with State Laws

- Tailor Made for Multi-Shift Operations

Trusted by 800+ Businesses

What is Payroll and Compliance Software?

Payroll and compliance software enables organizations to automatically calculate employee salaries, deduct taxes, and manage all statutory obligations like PF, ESI, and professional tax, without manual intervention.

Emgage’s solution provides an end-to-end payroll management system that integrates seamlessly with attendance, leaves, and compliance modules to ensure accurate payouts and regulatory adherence in India.

Faster Processing, Accurate Payouts

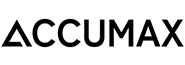

Completely Customisable

Create customised salary structures and grade-wise employee classes to process payroll as you need. Add allowances and calculate incentives automatically.

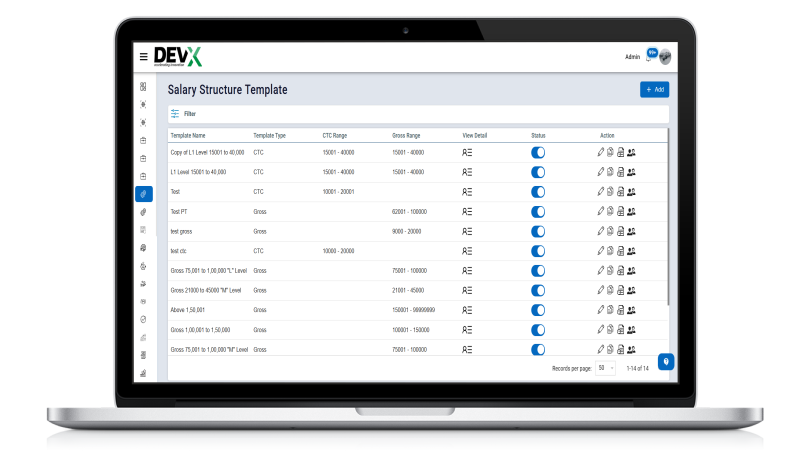

Stay Compliant, Always

Automated deduction of PF, ESIC, Professional Tax etc. as per state regulations so you are always compliant. Generate challans & forms in legal formats in one click.

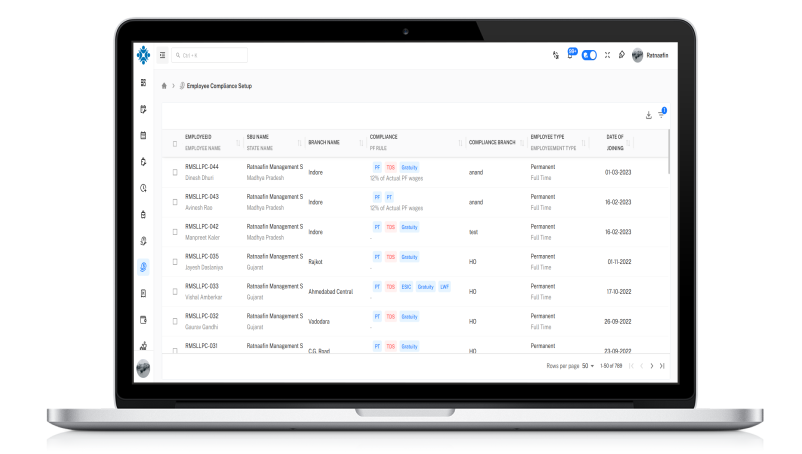

Employee Focused Platform

From income tax calculators to submitting investment declarations; requests for loans & advances to filing reimbursements, Emgage HRMS lets employees do more than just download payslips.

Payroll Compliance Doesn’t Have to Be Complicated

Key Features of Emgage’s

Payroll & Compliance Module

Configure salary structures, deductions, and allowances for fast, error-free payroll runs.

Auto-calculate and manage PF, ESI, TDS, Professional Tax, and LWF in line with Indian regulations.

Set monthly payroll cycles, define cut-off dates, and receive proactive alerts for filings.

Auto-generate digital payslips with complete breakdowns and email them securely to employees.

Generate TDS certificates, manage exemptions, and align with the latest income tax slabs.

Link payroll with attendance logs and leave records for accurate salary computations.

Frequently Asked Questions (FAQs)

Customer Testimonials

Neeraj Kumar, Founder & CEO

The Channel Pro Network

Shardul Patel, MD

4C Consulting Group